Indian Economics Service [IES] Exam 2026 Syllabus,Books,Exam Pattern,Educational Qualification, Final Cut-off,Job Role,Exam Level,age Limit

The Indian Economic Service (IES) is an organized Group ‘A’ Central Service. The Service works with the objective of institutionalising professional capacity to undertake economic analysis within the Government and use it for designing and formulating development policies, strengthening delivery systems, and monitoring and evaluating public programmes. The Cadre Controlling Authority of the IES is the Department of Economic Affairs, Ministry of Finance and the Service is managed on the basis of the Indian Economic Service Rules, as amended from time to time. A distinguishing feature of the Service is that its Cadre posts are spread across 72 different Ministries/ Departments of the Central Government.

Table of Contents

Indian Economic Service (IES) Exam Overview

| Category | Details |

|---|---|

| Conducting Authority | Union Public Service Commission (UPSC) |

| Exam Name | Indian Economic Service (IES) Examination |

| Services Recruited For | Indian Economic Service (Group ‘A’ Central Service) |

| Eligibility (Education) | Postgraduate degree in: • Economics • Applied Economics • Business Economics • Econometrics |

| Age Limit | 21 to 30 years (as on 1st August of exam year) + Relaxation for SC/ST/OBC/PH |

| Nationality | Indian Citizen |

| Attempts | Details about attempts and eligibility: General Category: 6 attempts. OBC Category: 9 attempts. SC/ST Category: No limit on attempts. |

| Exam Frequency | Once a year |

| Exam Mode | Offline (Pen and Paper) |

| Medium of Exam | English Only (except General English paper) |

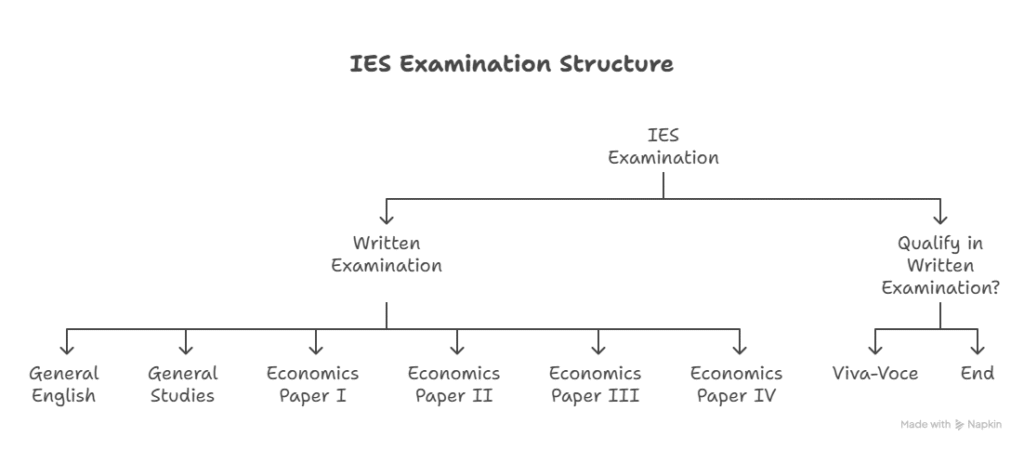

| Stages of Exam | 1. Written Examination (1000 marks) 2. Interview/Personality Test (200 marks) |

| Written Exam Pattern | 6 Papers – General English (100 marks) – General Studies (100 marks) – General Economics-I (200 marks) – General Economics-II (200 marks) – General Economics-III (200 marks) – Indian Economics (200 marks) |

| Exam Duration | 3 hours per paper |

| Negative Marking | No official negative marking |

| Interview Marks | 200 marks |

| Final Selection | Based on total marks: Written + Interview (1200 marks) |

| Application Mode | Online via https://upsconline.nic.in |

| Typical Notification Time | April – May |

| Exam Held In | June – July |

| Application Fee | ₹200 (No fee for SC/ST/Female/PwBD) |

| Job Departments | Ministry of Finance, NITI Aayog, RBI, Planning Commission, etc. |

| Job Role | Policy analysis, economic forecasting, budgeting, planning, etc. |

Indian Economic Service (IES) Exam Syllabus

GENERAL ENGLISH (COMMON TO BOTH IES/ISS)

Candidates will be required to write an essay in English. Other questions will be designed to test their understanding of English and workman like use of words. Passages

will usually be set for a summary or a precis.

GENERAL STUDIES (COMMON TO BOTH IES/ISS)

General knowledge, including knowledge of current events and such matters of everyday observation and experience in their scientific aspects as may be expected of an educated person who has not made a special study of any scientific subject. The paper will also include questions on Indian Polity, including the political system and the Constitution of India, History of India and Geography of a nature which a candidate should be able to answer without special study.

GENERAL ECONOMICS – I (For IES only)

PART A :

1. Theory of Consumer’s Demand—Cardinal utility Analysis: Marginal utility and demand, Consumer’s surplus, Indifference curve Analysis and utility function, Price,

income and substitution effects, Slutsky theorem and derivation of demand curve, Revealed preference theory. Duality and indirect utility function and expenditure function, Choice under risk and uncertainty. Simple games of complete information, Concept of Nash equilibrium.

2. Theory of Production: Factors of production and production function. Forms of Production Functions: Cobb Douglas, CES and Fixed coefficient type, Translog production function. Laws of return, Returns to scale and Return to factors of production. Duality and cost function, Measures of productive efficiency of firms, technical and allocative efficiency. Partial Equilibrium versus General Equilibrium approach. Equilibrium of the firm and industry.

3. Theory of Value: Pricing under different market structures, public sector pricing, marginal cost pricing, peak load pricing, cross-subsidy free pricing and average cost pricing. Marshallian and Walrasian stability analysis. Pricing with incomplete information and moral hazard problems.

4. Theory of Distribution: Neo classical distribution theories; Marginal productivity theory of determination of factor prices, Factor shares and adding up problems. Euler’s theorem, Pricing of factors under imperfect competition, monopoly and bilateral monopoly. Macro distribution theories of Ricardo, Marx, Kaldor, Kalecki.

5. Welfare Economics: Inter-personal comparison and aggression problem, Public goods and externalities, Divergence between social and private welfare, compensation principle. Pareto optimality. Social choice and other recent schools, including Coase and Sen.

PART B: Quantitative Methods in Economics

1. Mathematical Methods in Economics: Differentiation and Integration and their application in economics. Optimisation techniques, Sets, Matrices and their application in economics. Linear algebra and Linear programming in economics and the Input-output model of Leontief.

2. Statistical and Econometric Methods: Measures of central tendency and dispersions, Correlation and Regression. Time series. Index numbers. Sampling of curves

based on various linear and non-linear function. Least square methods and other multivariate analysis (only concepts and interpretation of results). Analysis of Variance,

Factor analysis, Principal component analysis, Discriminant analysis. Income distribution: Pareto law of Distribution, lognormal distribution, measurement of income inequality. Lorenz curve and Gini coefficient. Univariate and multivariate regression analysis. Problems and remedies of Heteroscedasticity, Autocorrelation and Multicollinearity

GENERAL ECONOMICS – II (For IES only)

1. Economic Thought: Mercantilism, Physiocrats, Classical, Marxist, Neo-classical, Keynesian, and Monetarist schools of thought.

2. Concept of National Income and Social Accounting: Measurement of National Income, Interrelationship between three measures of national income in the presence of the Government sector and International transactions. Environmental considerations, Green national income.

3. Theory of employment, Output, Inflation, Money and Finance: The Classical theory of Employment and Output and Neo classical approaches. Equilibrium, analysis under classical and neo classical approach. Keynesian theory of Employment and Output. Post Keynesian developments. The inflationary gap; Demand pull versus cost push inflation, the Philip’s curve and its policy implication. Classical theory of Money, Quantity theory of Money. Friedman’s restatement of the quantity theory, the neutrality of money. The supply and demand for loanable funds and equilibrium in financial markets, Keynes’ theory on demand for money. IS-LM Model and AD-AS Model in Keynesian Theory.

4. Financial and Capital Market: Finance and economic development, financial markets, stock market, gilt market, banking and insurance. Equity markets, Role of

primary and secondary markets and efficiency, Derivatives markets, Future and options.

5. Economic Growth and Development: Concepts of Economic Growth and Development and their measurement: characteristics of less developed countries and obstacles to their development – growth, poverty and income distribution. Theories of growth: Classical Approach: Adam Smith, Marx and Schumpeter- Neo classical approach; Robinson, Solow, Kaldor and Harrod Domar. Theories of Economic Development, Rostow, Rosenstein-Rodan, Nurke, Hirschman, Leibenstien and Arthur Lewis, Amin and Frank (Dependency school) respective role of state and the market. Utilitarian and Welfarist approach to social development and A.K. Sen’s critique. Sen’s capability approach to economic development. The Human Development Index. Physical Quality of Life Index and Human Poverty Index. Basics of Endogenous Growth Theory.

6. International Economics: Gains from International Trade, Terms of Trade, policy, international trade and economic development- Theories of International Trade; Ricardo, Haberler, Heckscher- Ohlin and Stopler- Samuelson- Theory of Tariffs- Regional Trade Arrangements. Asian Financial Crisis of 1997, Global Financial Crisis of 2008 and Euro Zone Crisis- Causes and Impact.

7. Balance of Payments: Disequilibrium in Balance of Payments, Mechanism of Adjustments, Foreign Trade Multiplier, Exchange Rates, Import and Exchange Controls and Multiple Exchange Rates. IS-LM Model and Mundell-Fleming Model of Balance of Payments.

8. Global Institutions: UN agencies dealing with economic aspects, role of Multilateral Development Bodies (MDBs), such as World Bank, IMF and WTO, Multinational

Corporations. G-20.

GENERAL ECONOMICS – III (For IES only)

1. Public Finance—Theories of taxation: Optimal taxes and tax reforms, incidence of taxation. Theories of public expenditure: objectives and effects of public expenditure, public expenditure policy and social cost benefit analysis, criteria of public investment decisions, social rate of discount, shadow prices of investment, unskilled labour and foreign exchange. Budgetary deficits. Theory of public debt management.

2. Environmental Economics—Environmentally sustainable development, Rio process 1992 to 2012, Green GDP, UN Methodology of Integrated Environmental and Economic Accounting. Environmental Values: Users and Non-Users values, option value. Valuation Methods: Stated and revealed preference methods. Design of Environmental Policy Instruments: Pollution taxes and Pollution permits, collective action and informal regulation by local communities. Theories of exhaustible and renewable resources. International environmental agreements, RIO Conventions. Climatic change problems. Kyoto protocol, UNFCC, Bali Action Plan, Agreements up to 2017, tradable permits and carbon taxes. Carbon Markets and Market Mechanisms. Climate Change Finance and Green Climate Fund.

3. Industrial Economics—Market structure, conduct and performance of firms, product differentiation and market concentration, monopolistic price theory and oligopolistic interdependence and pricing, entry preventing pricing, micro level investment decisions and the behaviour of firms, research and development and innovation, market structure and profitability, public policy and development of firms.

4. State, Market and Planning—Planning in a developing economy. Planning regulation and market. Indicative planning. Decentralised planning.

INDIAN ECONOMICS (For IES only)

1. History of development and planning— Alternative development strategies—goal of self-reliance based on import substitution and protection, the post-1991 globalisation strategies based on stabilisation and structural adjustment packages: fiscal reforms, financial sector reforms and trade reforms.

2. Federal Finance—Constitutional provisions relating to fiscal and financial powers of the states, Finance Commissions and their formulae for sharing taxes, Financial aspect of Sarkaria Commission Report, Financial aspects of 73rd and 74th Constitutional Amendments.

3. Budgeting and Fiscal Policy—Tax, expenditure, budgetary deficits, pension and fiscal reforms, Public debt management and reforms, Fiscal Responsibility and Budget Management (FRBM) Act, Black money and Parallel economy in India—definition, estimates, genesis, consequences and remedies.

4. Poverty, Unemployment and Human Development—Estimates of inequality and poverty measures for India, appraisal of Government measures, India’s human development record in global perspective. India’s population policy and development.

5. Agriculture and Rural Development Strategies— Technologies and institutions, land relations and land reforms, rural credit, modern farm inputs and marketing— price policy and subsidies; commercialisation and diversification. Rural development programmes including poverty alleviation programmes, development of economic and social infrastructure and New Rural Employment Guarantee Scheme.

6. India’s experience with Urbanisation and Migration—Different types of migratory flows and their impact on the economies of their origin and destination, the process of growth of urban settlements; urban development strategies.

7. Industry: Strategy of industrial development— Industrial Policy Reform; Reservation Policy relating to small scale industries. Competition policy, Sources of

industrial finance. Bank, share market, insurance companies, pension funds, non-banking sources and foreign direct investment, role of foreign capital for direct investment and portfolio investment, Public sector reform, privatisation and disinvestment.

8. Labour—Employment, unemployment and underemployment, industrial relation sand labour welfare— strategies for employment generation—Urban labour market and informal sector employment, Report of National Commission on Labour, Social issues relating to labour e.g. Child Labour, Bonded Labour International Labour Standard and its impact.

9. Foreign trade—Salient features of India’s foreign trade, composition, direction and organisation of trade, recent changes in trade, balance of payments, tariff policy, exchange rate, India and WTO requirements. Bilateral Trade Agreements and their implications.

10. Money and Banking—Financial sector reforms, Organisation of India’s money market, changing roles of the Reserve Bank of India, commercial banks, development

finance institutions, foreign banks and non-banking financial institutions, Indian capital market and SEBI, Development in Global Financial Market and its relationship with Indian Financial Sector. Commodity Market in India-Spot and Futures Market, Role of FMC.

11. Inflation—Definition, trends, estimates, consequences and remedies (control): Wholesale Price Index. Consumer Price Index: components and trends.

Indian Economics Service Exam Pattern

📘 General Economics – I (Total: 200 Marks)

| Section | Instructions | Marks |

|---|---|---|

| Section A | Answer all the following questions in about 100 words each | 5 × 7 = 35 |

| Section B | Attempt any 5 out of 7 medium-length analytical questions | 5 × 18 = 90 |

| Section C | Attempt any 3 out of 5 long essay-type questions | 3 × 25 = 75 |

| Total | 200 Marks |

📘 General Economics – II

Total Marks: 200

| Section | Details | Marks |

|---|---|---|

| Section A | Answer all the following questions in about 100 words each | 5 × 6 = 30 |

| Section B | Answer any 6 out of 9 questions (approx. 200 words each – analytical/exploratory) | 6 × 15 = 90 |

| Section C | Answer any 4 out of 6 questions (approx. 300 words each – detailed and theory-based) | 4 × 20 = 80 |

| Total | 200 Marks |

📘 General Economics – III (Paper III)

Total Marks: 200

| Section | Details | Marks |

|---|---|---|

| Section A | Answer all the following questions in about 100 words each | 5 × 6 = 30 |

| Section B | Answer any 6 out of 9 questions (approx. 200 words each – analytical & quantitative) | 6 × 15 = 90 |

| Section C | Answer any 4 out of 6 questions (approx. 300 words each – application + interpretation) | 4 × 20 = 80 |

| Total | 200 Marks |

📘 Indian Economics (Paper IV)

Total Marks: 200

| Section | Details | Marks |

|---|---|---|

| Section A | Answer all the following questions in about 100 words each | 5 × 6 = 30 |

| Section B | Answer any 6 out of 9 questions (approx. 200 words each – analytical/descriptive) | 6 × 15 = 90 |

| Section C | Answer any 4 out of 6 questions (approx. 300 words each – essay-type, policy analysis) | 4 × 20 = 80 |

| Total | 200 Marks |

📊 IES Exam Paper Analysis (2020–2024)

| Paper | 2020 – Key Focus & Level | 2021 – Key Focus & Level | 2022 – Key Focus & Level | 2023 – Key Focus & Level | Moderate–Difficult Agriculture, MSMEs, and Fiscal tools |

|---|---|---|---|---|---|

| General English | Moderate Essay on fiscal reforms Emphasis on précis & grammar | Moderate Essay on COVID-19 economy Vocabulary-heavy | Easy Essay on rural economy Grammar was direct | Moderate Essay on digital India Reading-based | Moderate Likely focus on climate economy, global inequality |

| General Studies | Moderate Govt schemes & Economic Survey IR sections appeared | Moderate COVID recovery, health sector Policy-based | Moderate Focus on NEP 2020, budget trends | Moderate Current affairs-heavy Green growth, SDGs | Moderate Likely themes: Budget 2024, WTO, geopolitics |

| General Economics–I | Difficult Elasticity, IS-LM, macro models Numerical-based | Moderate Market forms, AD/AS Definition-heavy | Difficult Microeconomics focused Less math | Difficult Phillips curve, Keynesian analysis Mathematical rigor | Moderate–Difficult Focus on demand-supply shocks, inflation |

| General Economics–II | Moderate Public goods, WTO, taxation Growth theory | Moderate Subsidy, trade policies Development models | Moderate Fiscal deficit, GST, BOP Conceptual | Moderate IMF, WEF, HDI, Kuznets curve Real-world links | Moderate Focus on climate finance, trade wars, welfare economics |

| General Economics–III | Difficult Econometrics + stats heavy Regression & hypothesis testing | Difficult Statistical methods, index numbers Environmental section increasing | Difficult Regression, time series Social sector data | Difficult Quantitative methods, environmental policies | Difficult Expected focus on advanced regression + SDG modeling |

| Indian Economics | Moderate Planning, NITI Aayog, Poverty COVID impact | Moderate Budget schemes, Employment Digital divide | Moderate–Difficult Agriculture, MSMEs, Fiscal tools | Moderate Budget 2023, women in economy, reforms | Moderate Likely focus: Budget 2024, energy transition, unemploym |

Indian Economic Service Eligibility Criteria

Here is the Eligibility Criteria for the Indian Economic Service (IES) as per UPSC guidelines:

📌 IES Eligibility Criteria

| Category | Details |

|---|---|

| Nationality | Must be a citizen of India |

| Age Limit | Minimum: 21 years Maximum: 30 years (as on 1st January of the exam year) |

| Age Relaxation | – SC/ST: 5 years – OBC: 3 years – PwBD: 10 years |

| Educational Qualification | Must have obtained a Postgraduate Degree in Economics, Applied Economics, Business Economics, or Econometrics from a recognized university. |

| Number of Attempts | Details about attempts and eligibility: General Category: 6 attempts. OBC Category: 9 attempts. SC/ST Category: No limit on attempts. |

| Physical Standards | Must meet the physical fitness requirements as per UPSC norms |

🔍 Key Points to Remember:

- The degree must be completed (not awaiting results) at the time of application.

- Candidates applying must check for relaxations under reserved categories as per the latest UPSC notification.

- The IES is a Group A Central Service, and selection is made through the UPSC IES/ISS Combined Examination.

🧾 Category-wise Age Relaxation

| Category | Maximum Age (Relaxation) |

|---|---|

| General / EWS | 30 years (No relaxation) |

| OBC (Non-Creamy Layer) | +3 years → up to 33 years |

| SC / ST | +5 years → up to 35 years |

| Jammu & Kashmir Domicile (1980–89) | +5 years |

| Defence Personnel (disabled in operations) | +3 years |

| Ex‑servicemen / ECOs/SSCOs | +5 years |

| Persons with Benchmark Disabilities (PwBD) | +10 years → e.g. general → 40, OBC → 43, SC/ST → 45 years |

📚 Indian Economic Service (IES) – Recommended Books Table

| Paper | Topic | Recommended Books / Authors |

|---|---|---|

| General English (Paper I) | Essay, précis, grammar | – Wren & Martin – High School English Grammar – Word Power Made Easy – Norman Lewis |

| General Studies (Paper II) | Indian Polity, Economy, History, etc. | – Lucent’s General Knowledge – Indian Polity – M. Laxmikanth – NCERT History & Geography (Class 9–12) |

| General Economics I | Microeconomics, Demand, Supply, etc. | – Modern Microeconomics – A. Koutsoyiannis – Microeconomic Theory – Hal R. Varian |

| General Economics II | Macroeconomics, Money, Banking, etc. | – Macroeconomics – N. Gregory Mankiw – Monetary Theory & Public Finance – H.L. Bhatia |

| General Economics III | Development Economics, Env. Economics | – Economic Development – Michael P. Todaro & Stephen C. Smith – Environmental Economics – Charles D. Kolstad |

| Indian Economics (Paper VI) | Indian Economy, Planning, Growth, etc. | – Indian Economy – Ramesh Singh – Indian Economy – Uma Kapila – Economic Survey (Latest) – Union Budget (Latest) |

Recommended Books

-

Indian Economics Service [IES] Practice Question Bank Book of 400 Questions With Written Answers By Expert Faculties of All 4 Papers

Original price was: ₹600.00.₹260.00Current price is: ₹260.00. -

Indian Economics Services II IES II Solved Previous year Paper [PYQ] II 2018 to 2024 II General Economics Paper 1,2 & 3 II 7 year Covered II Written Answer by Experts of Economics II All Sections A,B & C of Each Paper II By Diwakar Education Hub

Original price was: ₹800.00.₹650.00Current price is: ₹650.00.

📌 Cut-Off Marks & Final Selection Scores (2020–2024)

| Year | Category | Written Stage Cut-Off (out of 1000) | Final Cut-Off (Written + Interview; out of 1200) |

|---|---|---|---|

| 2020 | General | 460 | 595 |

| EWS | 389 | 497 | |

| OBC | 403 | 550 | |

| SC | 385 | 507 | |

| ST | 324 | 468 | |

| 2021 | General | 440 | 586 |

| EWS | 429 | 565 | |

| OBC | 373 | 532 | |

| SC | 335 | 484 | |

| ST | 363 | 479 | |

| 2022 | General | 418 | 585 |

| EWS | 359 | 567 | |

| OBC | 363 | 522 | |

| SC | 301 | 469 | |

| ST | 287 | 457 | |

| 2023 | General | 408 | 549 |

| EWS | 329 | 483 | |

| OBC | 370 | 506 | |

| SC | 309 | 456 | |

| ST | — (no vacancy) | — | |

| 2024 | General | 419 | 560 |

| EWS | 341 | 466 | |

| OBC | 373 | 534 | |

| SC | 327 | 457 | |

| ST | 316 | 475 |

🔹 Written stage cut-offs are minimum qualifying marks out of 1000.

🔹 Final cut-offs represent total selection marks out of 1200 (written + interview).

🔹 All non‑PwBD candidates must score at least 20% marks in each paper (PwBD need 5%)

Job Role

- A distinguishing feature of the Service is that its Cadre posts are spread across different Ministries/ Departments of the Central Government. It is an inter-Ministerial and inter-Departmental Service. Officers serve in a diverse range of subject areas, such as finance & economic affairs; social sector, including health, education, rural development; agriculture & allied sectors including food processing; industry & services; commerce & external affairs; infrastructure & technology and energy & environment. The number of ministries/departments have increased from 10 in 1979 to 55 in 2011 and to 72 in 2023.

- IES officers are, exposed to development issues in diverse sectors and contribute to policy-making in the Central Government over the entire span of their service career. With the economic reforms having transformed the nature and domain of economic policy-making in the country, the IES, as a service, provides a pool of in-house economic expertise that is well-placed to meet the growing demand for analytical economic inputs for policy-making in the government.

- Direct recruits joining the service, after being offered appointment, undergo a comprehensive probationary training comprising the Foundation course (conducted for the All-India Services and the Central Civil Services), training on Economics at the Institute of Economic Growth, Delhi, and training/ attachment at various national level Institutes of repute across the country.

- Capacity building of serving officers is carried out on an ongoing basis by conducting various in-service training programmes suited to the officers’ needs, from the point of view of building up professional capacity at work as well as developing soft skills. The flagship in-service training programme is the mid-career training programmes comprising domestic learning and foreign learning components, conducted at reputed management institute in the country. Officers of the service are required to participate in three such mid-career training courses at different phases in their career.

Previous Year Paper Indian Economics Service Exam

📅 Indian Economic Service – Indian Statistical Service Examination

🔹 2025

- General Studies

- General English

- Indian Economics

- General Economics Paper I

- General Economics Paper II

- General Economics Paper III

🔹 2024

- General Studies

- General English

- Indian Economics

- General Economics Paper I

- General Economics Paper II

- General Economics Paper III

🔹 2023

- General Studies

- General English

- Indian Economics

- General Economics Paper I

- General Economics Paper II

- General Economics Paper III

✅ Frequently Asked Questions – Indian Economic Service (IES) Exam

1. What is the Indian Economic Service (IES)?

The IES is a Group ‘A’ Central Service, recruited by UPSC for economic policy formulation and implementation in various departments of the Government of India.

2. Who conducts the IES Examination?

The Union Public Service Commission (UPSC) conducts the IES examination annually.

3. What are the eligibility criteria for the IES exam?

- Nationality: Indian Citizen

- Age Limit: 21 to 30 years (relaxation for reserved categories)

- Educational Qualification: Postgraduate degree in Economics, Applied Economics, Business Economics, or Econometrics.

4. Is there age relaxation for reserved categories?

Yes, the following relaxations apply:

- SC/ST: 5 years

- OBC: 3 years

- PwBD: 10 years

- Others (e.g., Ex-servicemen): As per UPSC norms

5. What is the exam pattern for IES?

The exam consists of:

- Written Examination (1000 marks)

- Interview/Personality Test (200 marks)

Written Papers:

| Paper | Marks |

|---|---|

| General English | 100 |

| General Studies | 100 |

| General Economics – Paper I | 200 |

| General Economics – Paper II | 200 |

| General Economics – Paper III | 200 |

| Indian Economics | 200 |

6. Is there negative marking in the IES exam?

There is no negative marking in written descriptive papers.

7. How competitive is the IES exam?

It is highly competitive. Usually, only 15–30 seats are offered yearly for IES, and over 5,000–10,000 candidates appear.

8. Which books are recommended for IES preparation?

- M.L. Jhingan, H.L. Ahuja – for Indian Economics

- Dornbusch & Fischer, Mankiw, Froyen – for General Economics

- NCERTs, Indian Economy by Ramesh Singh – for GS and current affairs

Click here for the detailed booklist →

9. Where can I find previous year question papers?

Visit the official UPSC Previous Papers Page

10. What is the cut-off or passing marks for IES?

Varies year to year. Generally, candidates scoring above 45–50% aggregate (including interview) stand a good chance.