JAIIB Exam 2026 Syllabus,Books,Exam Pattern, Passing Marks,IIBF Memebership,Career Scope,2026 Exam Date

The Junior Associate of the Indian Institute of Bankers (JAIIB) examination is one of the most respected and widely attempted professional certification exams in the Indian banking and finance sector. Conducted by the Indian Institute of Banking and Finance (IIBF), the JAIIB exam is designed to enhance the fundamental knowledge and professional competence of banking employees. Clearing this exam not only strengthens conceptual understanding but also opens doors to career growth, promotions, and monetary benefits within banks and financial institutions.

Table of Contents

What is the JAIIB Exam?

The JAIIB is an entry-level professional certification offered by IIBF for employees working in banks and financial institutions. The primary objective of the JAIIB exam is to provide basic knowledge of banking operations, accounting, customer relations, and the legal aspects of banking.

It acts as a foundation course, especially for newly recruited clerks, probationary officers, and junior-level banking staff.

Why JAIIB is Not Mandatory

- There is no RBI or government rule that makes JAIIB compulsory for every banker.

- A person can work and continue service in a bank without clearing JAIIB.

- Even after promotion in some banks, JAIIB is not a legal requirement.

Why JAIIB is Practically Important

Although not mandatory by law, JAIIB becomes functionally essential in many banks because:

1. Promotions

- In most public sector banks, JAIIB is mandatory for promotion from:

- Clerk → Officer

- Officer → Scale-II (in many banks)

- Without JAIIB, promotion chances are delayed or blocked.

2. Salary & Increments

- Many banks give:

- One or two advance increments

- Special allowances

- These benefits are available only after passing JAIIB.

Is IIBF Membership Mandatory for JAIIB?

Yes, it is compulsory.

The JAIIB exam is conducted by the Indian Institute of Banking and Finance (IIBF), and only registered members of IIBF are eligible to apply for the JAIIB examination.

👉 No membership = No JAIIB application

Who Can Take IIBF Membership?

You are eligible for IIBF membership if:

- You are working in a bank or financial institution

- You are sponsored/certified by your employer

- You submit proof of employment

There is no age limit and no minimum educational qualification specified by IIBF.

Types of IIBF Membership (Relevant for JAIIB)

For JAIIB, you need:

- Ordinary Membership

This membership is valid as long as you are in the banking/finance service (subject to renewal rules).

Process of Taking IIBF Membership (Step-by-Step)

Step 1: Visit the Official IIBF Portal

Go to the official website of IIBF and choose the “Membership” option.

Step 2: Select “Apply for Membership”

- Choose Ordinary Membership

- Read eligibility instructions carefully

Step 3: Fill the Membership Application Form

You need to enter:

- Personal details

- Bank/Institution name

- Employee ID

- Branch and designation

- Contact details

Step 4: Upload Required Documents

Generally required documents:

- Proof of employment (ID card or employer certificate)

- Passport-size photograph

- Signature

- Identity proof (if asked)

Step 5: Pay Membership Fees

- The membership fee is paid online

- Fee amount is decided by IIBF and may change from time to time

Step 6: Verification by Bank / Institution

- Your application is verified by your bank

- After approval, IIBF issues:

- Membership Number

- Login credentials

Step 7: Membership Confirmation

Once approved:

- You officially become an IIBF Member

- You can now apply for JAIIB exam

Eligibility Criteria

To appear for the JAIIB exam:

- The candidate must be a member of IIBF

- He/she must be working in the banking or finance sector

- Membership can be obtained by enrolling through IIBF

There is no minimum educational qualification prescribed beyond employment in the banking/financial sector, which makes the exam accessible to a wide range of professionals.

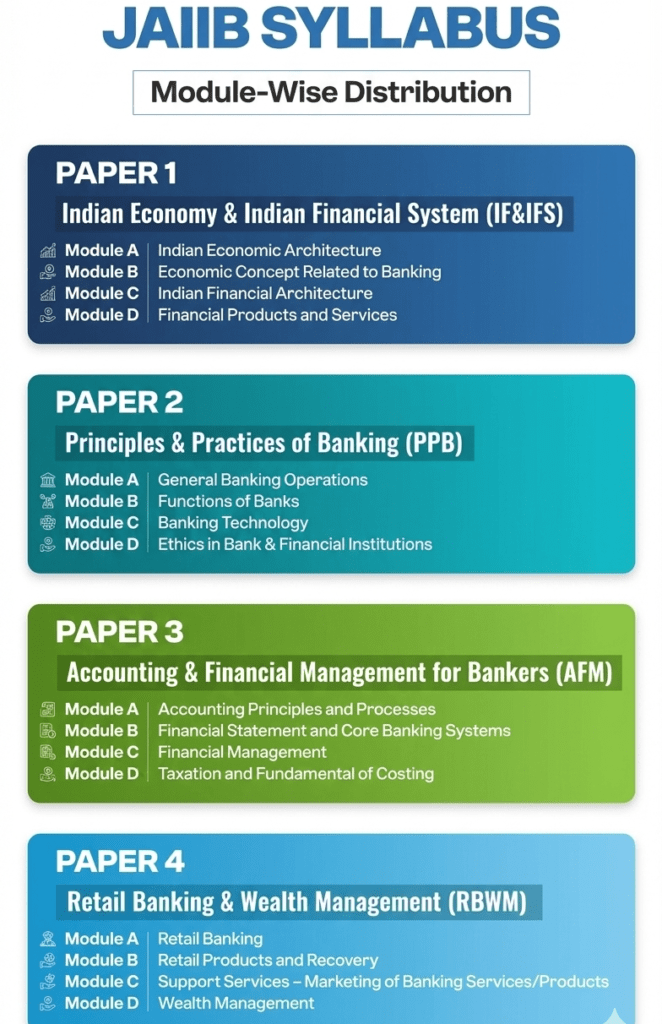

Subjects of Examination

The examination consists of the following four compulsory subjects:

- Indian Economy & Indian Financial System

- Principles & Practices of Banking

- Accounting & Financial Management for Bankers

- Retail Banking & Wealth Management

Passing Criteria

To successfully qualify the examination, candidates must meet one of the following conditions:

- A candidate must secure a minimum of 50 marks out of 100 in each subject.

OR

- A candidate securing at least 45 marks in each subject and an overall aggregate of 50% marks in all subjects in a single attempt shall be declared as having passed the examination.

Time Limit for Passing the Examination

- A candidate is allowed a maximum of five attempts to complete the JAIIB examination, within a period of three years from the date of registration for the first attempt, whichever occurs earlier. These five attempts need not be consecutive.

- Candidates who fail to pass the examination within three years or within five attempts, whichever is earlier, must re-enrol afresh. In such cases, credits obtained for any subject(s) passed earlier shall lapse and will not be carried forward.

- The three-year time limit and five-attempt count shall commence from the date of registration for the first attempt. An attempt shall be counted once a candidate applies for the examination, irrespective of whether the candidate actually appears for the examination or not.

- Under these rules, a candidate is generally eligible to apply for any five examination cycles conducted within the stipulated three-year period. If a candidate exhausts all five attempts before the completion of three years, re-enrolment will be mandatory. Similarly, if the three-year period expires before utilizing all five attempts, the candidate will still be required to re-enrol.

Examination Fees (For Examination Centres in India)

The examination fees for the JAIIB exam are prescribed as follows:

| Attempt | Examination Fee |

|---|---|

| First Attempt | ₹4,000 |

| Second Attempt | ₹1,300 |

| Third Attempt | ₹1,300 |

| Fourth Attempt | ₹1,300 |

| Fifth Attempt | ₹1,300 |

Medium of Examination

Candidates are permitted to attempt the examination either in English or in Hindi. The choice of medium must be clearly indicated at the time of online registration.Once selected, no change in the medium of examination will be allowed at any later stage.

Pattern of Examination

- Each question paper will consist of approximately 100 objective-type Multiple Choice Questions (MCQs) carrying a total of 100 marks. However, the Institute reserves the right to vary the number of questions for any subject, if required.

- The examination shall be conducted exclusively in Online (Computer-Based) Mode.

- There shall be no negative marking for incorrect answers.

Duration of Examination

- The duration of each paper of the examination shall be 2 hours.

Periodicity and Examination Centres

a) The examination shall be conducted on pre-announced dates, which will be notified on the official IIBF website. Normally, the Institute conducts the examination on a half-yearly basis. However, the frequency of the examination may be altered depending on the requirements of the banking industry.

b) The list of examination centres will be made available on the official website. The Institute will conduct the examination only at those centres where a minimum of 20 candidates have registered.

JAIIB Latest Revised Syllabus

JAIIB Latest Books

| Sr. No. | Examination | Medium | Name of the Book | Edition | Price (Rs.) |

|---|---|---|---|---|---|

| 1 | JAIIB | English | Indian Economy and Financial System | 2023 | Rs.865/- |

| 2 | JAIIB | English | Principles and Practices of Banking | 2023 | Rs.1250/- |

| 3 | JAIIB | English | Accounting & Financial Management for Bankers | 2023 | Rs.825/- |

| 4 | JAIIB | English | Retail Banking & Wealth Management | 2023 | Rs.840/- |

| 5 | JAIIB | Hindi | Principles and Practices of Banking (Banking Ke Siddhant Aur Vyavahar) | 2024 | Rs.2500/- |

| 6 | JAIIB | Hindi | Accounting and Financial Management for bankers (Bankaro Ke Liye Lekhankan Aur Vitta Prabandhan) | 2024 | Rs.1700/- |

| 7 | JAIIB | Hindi | Indian Economy and Indian Financial System (Bhartiya Arthavyavastha Aur Bhartiya Vittiya Pranali) | 2024 | Rs.1700/- |

| 7 | JAIIB | Hindi | Retail Banking & Wealth Management (Khudara Banking Aur Dhan Prabhandhan) | 2024 | Rs.1700/ |

Recommended products

-

JAIIB Question Bank Book 3500 MCQ with Explanation Module Wise Paper 1,2,3&4 As Per Updated Syllabus 2026

Original price was: ₹1,000.00.₹599.00Current price is: ₹599.00. -

JAIIB Book Hindi Medium Question Bank Book Paper 1,2,3 & 4 II All 4 Paper II 3000 MCQ With Detail Solution All Moudules Covered A,B,C & D of Each Paper II By Diwakar Education Publication

Original price was: ₹800.00.₹599.00Current price is: ₹599.00.

JAIIB 2026 Important Exam Dates: May-June Session

The official JAIIB exam dates have not been released yet. However, the JAIIB May/June 2026 session is expected to begin on the 1st Sunday of May 2026, 3 May 2026, based on the pattern followed in the May/June 2025 session.

To understand this better, here are the official dates from the JAIIB May/June 2026 session:

- Registration Starts: 4 February 2025

- Registration Ends: 24 February 2025

- IE & IFS: 4 May 2025 (Sunday)

- PPB: 10 May 2025 (Saturday)

- AFM: 11 May 2025 (Sunday)

- RBWM: 18 May 2025 (Saturday)

Based on this pattern, here are the expected dates for the JAIIB May/June 2026 session:

| JAIIB May/June 2026 Important Exam Dates | |

| Event | Expected Dates |

| Online Registration Starts | Early February 2026 |

| Online Registration Last Date | End of February 2026 |

| JAIIB 2026 Exam Dates Window | 3 May 2026 to 17 May 2026 |

| Indian Economy and Indian Financial System (IE & IFS) | 3 May 2026 |

| Principles and Practices of Banking (PPB) | 9 May 2026 |

| Accounting & Financial Management for Bankers (AFM) | 10 May 2026 |

| Retail Banking and Wealth Management (RBWM) | 17 May 2026 |

JAIIB 2026 Important Exam Dates: October/November Session

The JAIIB October/November 2026 session is expected to begin on the 1st Sunday of November 2026, i.e., 1 November 2026, based on the pattern followed in the Oct/Nov 2025 session.

To understand this better, here are the official dates from the JAIIB October/November 2025 session:

- Registration Starts: 1 August 2025

- Registration Ends: 21 August 2025 (Extended to 30 August)

- IE & IFS: 2 November 2025 (Sunday)

- PPB: 8 November 2025 (Saturday)

- AFM: 9 November 2025 (Sunday)

- RBWM: 16 November 2025 (Saturday)

Based on this pattern, here are the expected dates for the JAIIB October/November 2026 session:

| JAIIB October/November 2026 Important Exam Dates | |

| Event | Expected Dates |

| Online Registration Starts | Early August 2026 |

| Online Registration Last Date | End of August 2026 |

| JAIIB 2026 Exam Dates Window | 1 November 2026 to 15 November 2026 |

| Indian Economy and Indian Financial System (IE & IFS) | 1 November 2026 |

| Principles and Practices of Banking (PPB) | 7 November 2026 |

| Accounting & Financial Management for Bankers (AFM) | 8 November 2026 |

| Retail Banking and Wealth Management (RBWM) | 15 November 2026 |

Career Scope After JAIIB (Junior Associate of the Indian Institute of Bankers)

The JAIIB (Junior Associate of the Indian Institute of Bankers) examination is a foundational professional qualification for banking and finance professionals in India. Clearing JAIIB significantly enhances career growth, financial benefits, and professional credibility, especially for those working in the banking sector.

1. Career Growth & Promotions

JAIIB is widely recognized by public sector banks, private banks, and RRBs as an essential qualification for career progression.

- Helps in clerical to officer cadre promotions

- Acts as a qualifying or preferred criterion in internal promotion exams

- Strengthens eligibility for specialized banking roles

Many banks award additional marks or weightage to JAIIB-qualified candidates during promotion assessments.

2. Salary Increment & Financial Benefits

Most banks provide monetary incentives to employees who pass JAIIB:

- Fixed salary increment(s) as per bank settlement

- Special allowance/qualification pay

- Long-term impact on DA, HRA, pension, and retirement benefits

(Exact benefits vary from bank to bank as per bipartite settlements.)

3. Enhanced Job Roles & Responsibilities

After qualifying JAIIB, bankers are often considered for roles involving:

- Customer relationship management

- Retail and corporate credit operations

- Branch banking and operations

- Loan processing and appraisal

- Compliance, audit, and risk management

The syllabus equips candidates with practical banking knowledge, making them more effective in daily operations.

4. Eligibility for CAIIB & Specialization

JAIIB is the gateway qualification for CAIIB (Certified Associate of IIBF):

- CAIIB leads to higher promotions

- Opens doors to specialized departments like Treasury, Risk, Forex, and Credit

- Provides additional salary increments

5. Improved Transfer & Posting Opportunities

- Preference for urban / specialized branches

- Better chances of posting in credit, retail, or administrative offices

- Useful for inter-departmental transfers

6. Recognition Across Banking & Financial Institutions

JAIIB is valued in:

- Public Sector Banks

- Private Sector Banks

- Regional Rural Banks

- Cooperative Banks

- NBFCs and Financial Institutions

- Insurance & Mutual Fund companies

7. Long-Term Career Stability

- Builds a strong professional foundation

- Enhances job security

- Improves confidence and decision-making ability

8. Advantage for Competitive & Internal Exams

Knowledge gained in JAIIB helps in:

- Bank promotion exams

- Internal assessments

- Interviews for senior roles

- Other finance-related certifications

Frequently Asked Questions JAIIB

1. What is JAIIB?

JAIIB stands for Junior Associate of the Indian Institute of Bankers. It is a professional certification conducted by the Indian Institute of Banking & Finance (IIBF) to strengthen the foundational knowledge of banking professionals.

2. Is JAIIB mandatory for bank employees?

No, JAIIB is not mandatory for all bank employees. However, most banks strongly encourage it because it helps in promotions, salary increments, and career growth.

3. Who is eligible to appear for the JAIIB exam?

Only ordinary members of IIBF who are working in banks or financial institutions can appear for the JAIIB examination.

4. Is IIBF membership compulsory before applying for JAIIB?

Yes, IIBF membership is mandatory. Candidates must obtain IIBF ordinary membership before registering for the JAIIB exam.

5. How many subjects are there in JAIIB?

There are four compulsory subjects:

- Indian Economy & Indian Financial System

- Principles & Practices of Banking

- Accounting & Financial Management for Bankers

- Retail Banking & Wealth Management

6. What is the passing criterion for JAIIB?

A candidate must:

- Score 50 marks out of 100 in each subject, OR

- Score 45 marks in each subject with an aggregate of 50% marks in a single attempt.

7. How many attempts are allowed for JAIIB?

A candidate is allowed five attempts within a maximum period of three years, whichever is earlier, from the date of first registration.

8. Can I retain credit for passed subjects?

Yes. Credits for subjects passed can be retained until the expiry of the three-year time limit or five attempts, whichever is earlier.

9. What happens if I fail to pass JAIIB within the time limit?

If a candidate does not pass within three years or five attempts, they must re-enrol afresh, and all previous credits will lapse.

10. What is the exam pattern of JAIIB?

- Around 100 MCQs for 100 marks

- Online (Computer-Based) exam

- No negative marking

- Duration: 2 hours per paper

11. In which medium is the JAIIB exam conducted?

The exam can be attempted either in English or Hindi, which must be selected at the time of registration and cannot be changed later.

12. How often is the JAIIB exam conducted?

The exam is generally conducted on a half-yearly basis, though the schedule may change depending on industry requirements.

13. What are the examination fees for JAIIB?

For examination centres in India:

- First attempt: ₹4,000

- Second to fifth attempt: ₹1,300 per attempt

14. Does JAIIB provide salary benefits?

Yes. Most banks offer salary increments or special allowances to employees who clear JAIIB, as per bank policies and settlements.

15. Can I appear for CAIIB without passing JAIIB?

No. Passing JAIIB is mandatory before appearing for the CAIIB examination.

16. Is JAIIB useful for private bank employees?

Yes. While benefits may vary, JAIIB is recognized across public, private, cooperative banks, and financial institutions.

17. Does JAIIB help in promotions?

Yes. JAIIB significantly improves promotion prospects, as many banks give additional marks or preference to JAIIB-qualified employees.

18. Is there negative marking in JAIIB?

No. There is no negative marking for wrong answers.

19. Can the exam centre be changed after registration?

Generally, changes are not allowed after registration, except as per IIBF guidelines.

20. Is JAIIB difficult to pass?

JAIIB is moderate in difficulty. With systematic study and practice, most candidates clear it within 1–2 attempts.